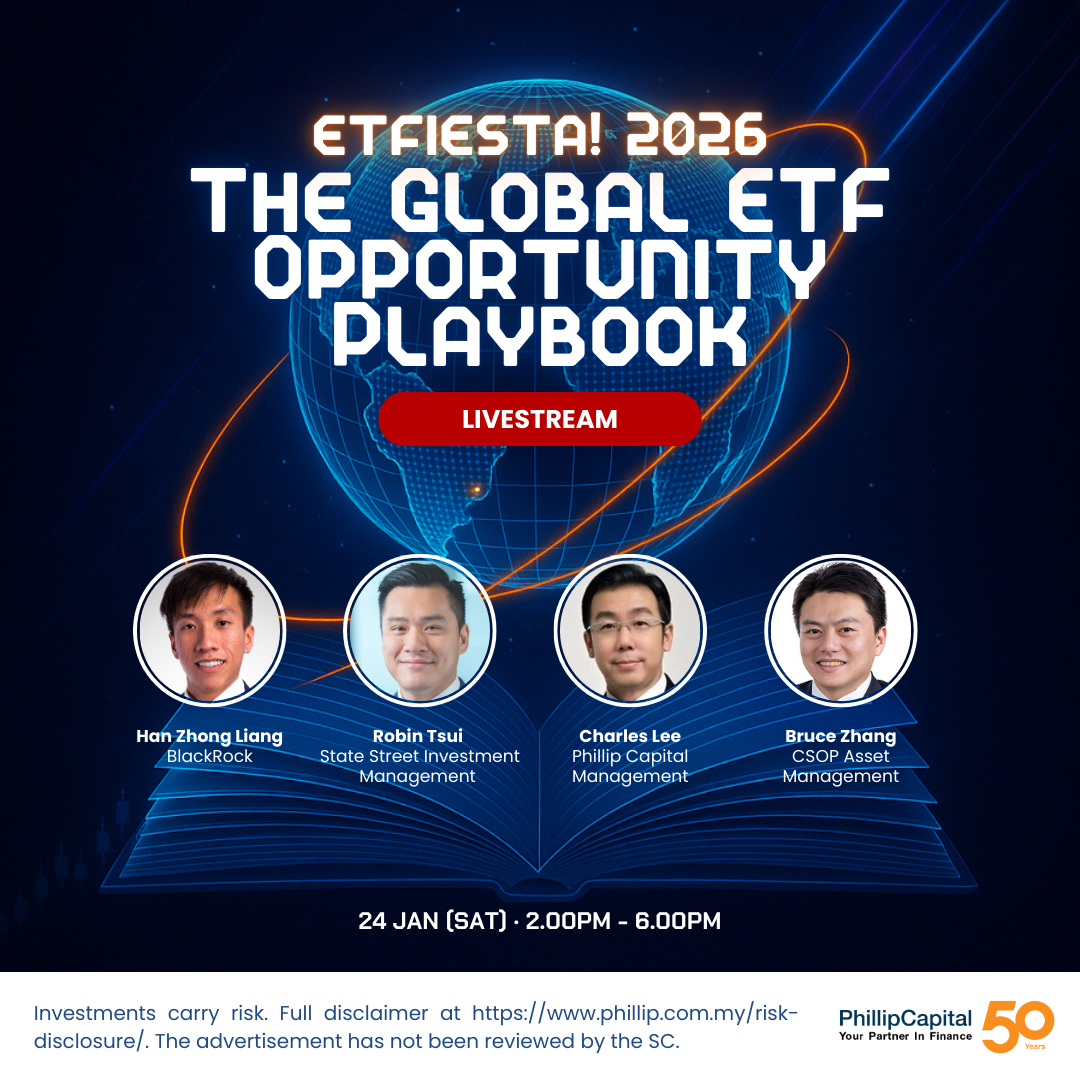

Mr. Han Zhong Liang

BlackRock Senior Investment Strategist

2026 US Market Outlook: Navigating the AI Boom and Macro Tailwinds

The 2026 Global Outlook positions the US as a key player amid a significant shift in investments driven by the rapid expansion of AI. Increased tech spending and resilient US economy present both opportunities and potential risks for investors. Join Zhong Liang from BlackRock to explore how AI is shaping capital allocation, market concentration, and diversification strategies. As the US economy grows faster, adopting a more dynamic investment approach and adjusting portfolios becomes increasingly important

Mr. Robin Tsui

State Street Investment Management

Gold Market Outlook 2026: Can Gold’s Bull Run Continue Toward US$5,000?

Gold enters 2026 at historic highs, fuelled by easing monetary policy, geopolitical uncertainty, and strong central bank and

investor demand. This session explores how these structural drivers—along with de-dollarisation trends—signal a sustained bull run, with projections of prices approaching US$5,000 under certain scenarios. Attendees will gain actionable strategies to leverage gold’s role as a safe haven and portfolio stabilizer amid global uncertainty.

Mr. Charles Lee

Phillip Capital Management Senior Fund Manager

Singapore Market Outlook 2026: Where Stability Meets Opportunity

Singapore continues to play a strategic role in global portfolios, offering resilience and income stability. This session explores the

strength of banks, the appeal of REITs and dividends, and how shifts in global interest rates may affect key STI components. Charles from Phillip Capital Management will also highlight periods when Singapore has historically outperformed global markets, and how investors can use Singapore ETFs to capture income and stability in 2026.

Mr. Bruce Zhang

CSOP Asset Management Head of Fixed Income

2026 China/Hong Kong Market Outlook: Finding Opportunity Amid Recovery and Ref

2025 saw renewed investor interest in Asia, but China’s recovery remains uneven, with mixed economic signals shaping expectations for the year ahead. This session takes a closer look at the China/Hong Kong macro outlook for 2026 — exploring policy developments, growth drivers, risks to watch, and areas where value and opportunity may emerge as the region continues to stabilise. Join Bruce from Phillip Capital Management as he shares key insights, potential catalysts, and the opportunity windows to watch in 2026.

Position Your Portfolio for 2026 with Global ETF Insights

Position Your Portfolio for 2026 with Global ETF Insights