LATEST WEEKLY MARKET VIEWS (23/6/2025)

(1) Crude Palm Oil Weekly

Malaysian palm oil futures declined onMonday, pressured by weaker rival Dalian oils, while stronger crude oil prices and a softer ringgit capped the fall.

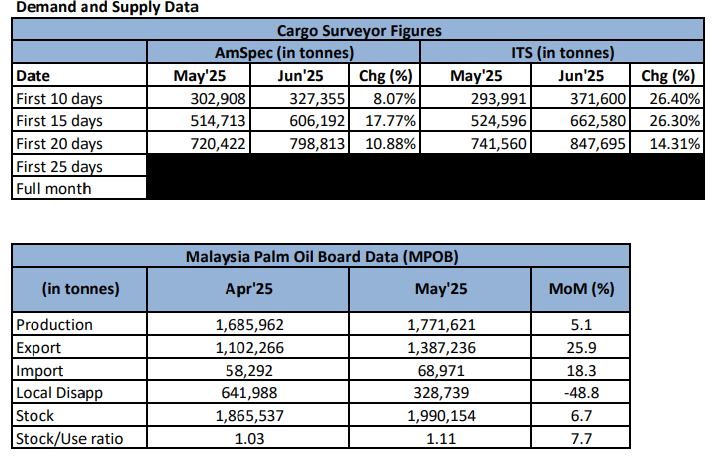

MPOB data

Read More: Crude Palm Oil Weekly

(2) Metals Weekly

Gold prices erased their bullish opening gap of around \$25 as markets reacted to weekend developments involving U.S. military action in the Israel-Iran conflict.

Read More: Metals Weekly

(3) Crude Oil Weekly

Oil prices touched a five-month high before paring gains on Monday as oil and gas transit continued on tankers from the Middle East after U.S. airstrikes against Iran at the weekend.

Read More: Crude Oil Weekly

(4) Financial Weekly

Malaysia’s benchmark KLCI ended 0.1% higher at 1502.74 amid lower probability of U.S. intervention in Iran; White House statement yesterday said President Donald Trump will decide within two weeks whether to strike Iran and that there was “substantial chance” of a negotiated settlement.

Read More: Financial Weekly

(5) Grains Weekly

CBOT Nov 25 Soybean increased 0.569% for this week.

Read More: Grains Weekly

Risk Disclaimer:

This advertisement is for general information only and does not constitute a recommendation, offer or solicitation to buy or sell any investment product. It does not have regard to your specific investment objectives, financial situation or particular needs. Investments are subject to investment risks. The risk of loss in Futures trading can be substantial and you could lose in excess of your initial funds. You may wish to seek advice from a registered representative, pursuant to a separate engagement, and to read the governing Terms and Conditions and the Risk Disclosure Statement carefully before making a decision whether or not to invest in such products.