NOVA

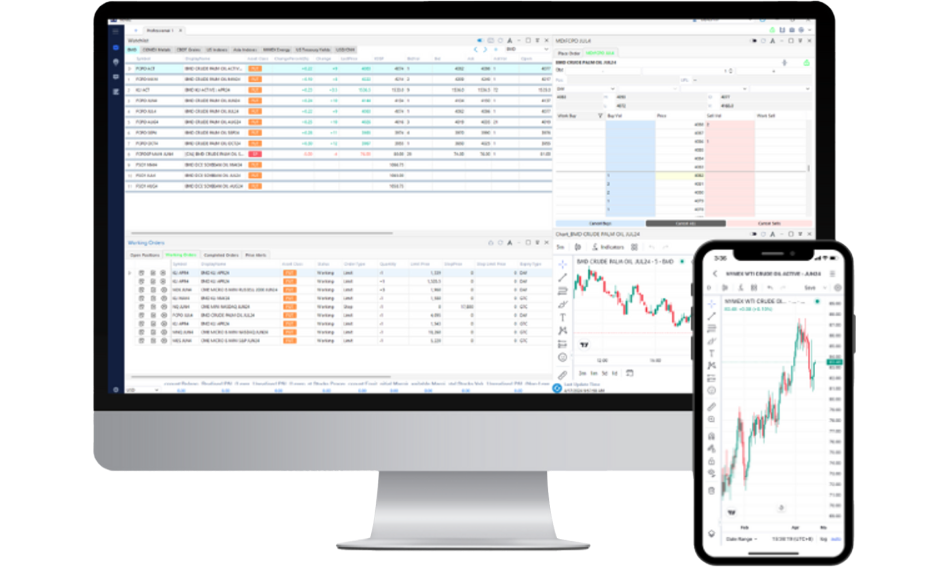

Equipped with over 100 technical indicators, live charts and a Market Depth Trading Tool, NOVA is your ideal trading companion.

Complete Trading Solutions

NOVA is a powerful, intuitive platform that enables effective trading of Futures from your desktop browser, tablet or mobile phone. Equipped with over 100 technical indicators, live charts and a Market Depth Trading Tool, NOVA is your ideal trading companion, with no extra charges.

Why Trade with NOVA?

-

Intuitive Interface

User-friendly interface, highly mobile responsive and fully customisable desktop trading layout -

Complete Trading Solutions

Options trading, calendar spread and market depth tools available

-

Comprehensive Tools and Features

Experience fast and responsive live charts powered by TradingView, featuring over 100 technical indicators -

Multi Asset-Class Support

Access to more than 15 global exchanges all in one platform with no platform fee

The NOVA Suite

NOVA

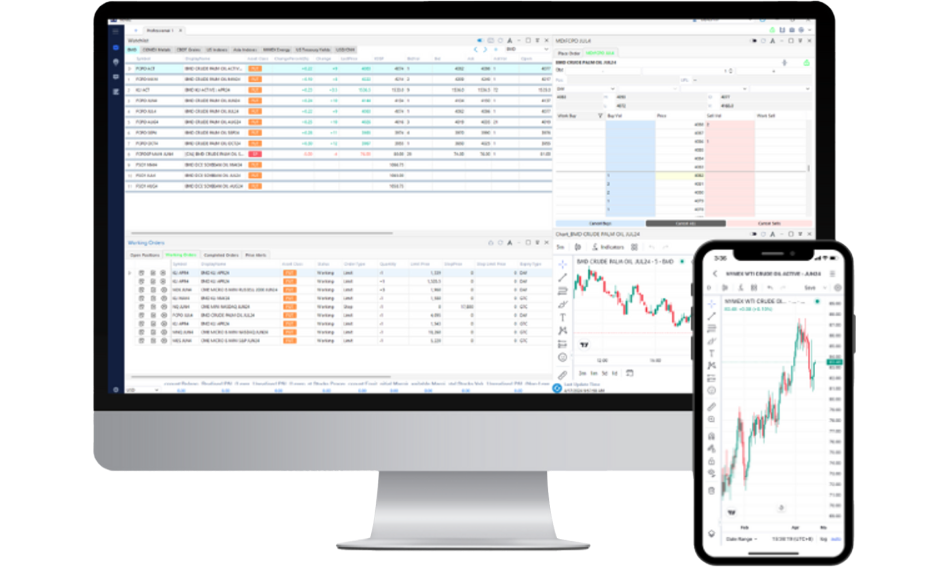

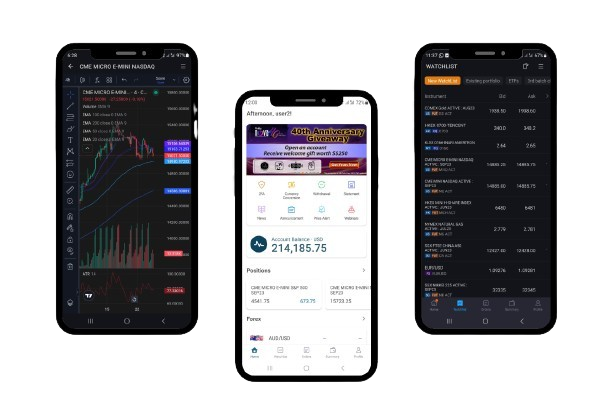

Capture opportunities Futures on the go with the new NOVA. Enjoy charting powered by TradingView, trade effectively with an inbuilt market depth tool and experience our tight forex spreads. Focus only on trading with zero custodian and platform fees too.

Charting powered by TradingView

- Gain access to over 100 technical indicators

Market Depth

- View liquidity and tradesfor a particular price in the market easily

Set Price Alerts

- Never miss a trading opportunity

Comes with light & dark modes

- Gain better focus with your preferred mode

![]()

NOVA.I can assist you with

⭐ Market analysis and Q&A

Ask about market trends, economic data, or specific stocks — NOVA.I will do its best to provide helpful insights.

Trading ideas

Trading ideas

Get trading inspiration based on market conditions, technical indicators, and your own queries.

⭐ Learning on demand

Curious about different trading strategies or financial instruments? NOVA.I can help break it down, anytime you ask.

NOVA User Guide

View our user guides to trade more effectively with NOVA now.

How to download and login to Phillip Nova 2.0 (Part 1)

How to add contracts & manage your watchlist (Part 2)

How to place trades and manage your orders (Part 3)

How to add indicators to a chart and save as template (Part 4)

Frequently Asked Question

A futures contract is a standardized agreement, made on a futures exchange, to buy or sell a predetermined quantity and quality of a specified commodity or financial instrument at a future date.

In the futures trading industry, a commodity refers to a product that lends itself to standardization for the purpose of futures contracts. Types of commodities include agricultural products (such as wheat, soybeans, cotton, sugar, cocoa), metals (gold, silver, platinum), and energy (crude oil).

A futures exchange is an organized marketplace where participants buy and sell futures contracts or futures options. Examples include:

- Malaysia: Bursa Malaysia Derivatives (BMD)

- London: International Petroleum Exchange (IPE), London International Financial Futures and Options Exchange (LIFFE)

- Japan: Tokyo Commodity Exchange (TOCOM)

- Hong Kong: Hong Kong Futures Exchange and Clearing Limited (HKFE)

- Singapore: Singapore Exchange Limited (SGX)

- Germany: Eurex Exchange (EUREX)

- United States: Chicago Mercantile Exchange (CME), New York Mercantile Exchange (NYMEX), Chicago Board of Trade (CBOT), New York Board of Trade (NYBOT) and Commodity Exchange (COMEX).

To get started you need to open an Individual Account with the following process:

- Fill up account opening forms:

Client details

Client agreement - Provide documents:

NRIC to pass Ctos KYC - Activate an account

Fund in initial deposit of minimum RM1000

*For Corporate account opening, please contact 03-9212 2820/03-2162 1628

Phillip Capital regularly emails a product list including margin requirements. You may also contact our Dealing team at 03-9212 2828 / 03-2162 1628 or Marketing team at 03-9212 2820.

Yes. Clients enjoy free live charting tools integrated into the Phillip Nova trading platform.

Futures contracts are used for:

- Hedging: Reducing risk from price fluctuations

- Speculation: Profiting from price movements

- Arbitrage: Exploiting price differences across markets

We provide the following services to our clients:

- 24 hours broking and execution services

- Access Global futures products*

- Free access to our online trading system, Phillip Nova 2.0

- 90 products from various exchanges

- Daily and weekly research reports

- Tradingview Integration

We offer a robust suite of tools and global market access to help you trade futures and commodities confidently. Whether you’re a beginner or a seasoned investor, we provide the guidance and technology you need to succeed.

FKLI is the FTSE Bursa Malaysia KLCI Futures — a derivative based on Malaysia’s benchmark stock index for hedging or speculation.

FCPO stands for Crude Palm Oil Futures — one of the most actively traded commodities on Bursa Malaysia Derivatives.

FGLD is a gold futures contract on Bursa Malaysia Derivatives, quoted in USD but settled in MYR. It offers smaller contract sizes, ideal for retail investors.

FCNH refers to USD/CNH Futures — a contract based on the offshore Chinese Yuan. It allows investors to hedge RMB currency exposure or speculate on currency movements.

Visit NOVA and use your registered User ID and password in email. If you’ve forgotten your login, use the “Forgot Password” feature or contact support.

Yes! You can download the NOVA mobile app from the App Store or Google Play.

NOVA comes with its own built-in charting tools with the same charting UI as TradingView. Besides, with a premium subscription, you can also link your account to TradingView for both advanced chart analysis and trade execution, however clients must purchase the live market data from Tradingview as Tradingview manages their own live market data feed.

You can deposit funds via bank transfer to our trust account, followed by emailing the bank-in slip to our Dealing team or your branch’s dealer representative.

During business hours (9 AM – 6 PM), deposits are typically reflected within 30 minutes of receiving your bank-in slip.

Initial Margin is the amount needed to open a position. Maintenance Margin is the minimum balance required to keep your position open.

A margin call occurs when your account equity falls below the maintenance margin. You’ll need to top up funds or reduce your position to meet the requirement.

Positions may be auto-liquidated to prevent further losses. It’s important to monitor your account during volatile markets.

Yes. You can view our market commentary and outlook reports on our website or subscribe to our newsletter for updates.

We provide both. Our research team shares insights on technical trends and fundamental developments across FKLI, FCPO, and global futures products.

Yes! We regularly host free webinars and physical seminars on futures trading, technical analysis, and market strategies.

Visit our Events Page to see upcoming events and register.

Need a user-guide that is not here yet?

Simply send us an email via

pcsb_enquiry@phillipcapital.com.my to make a request.

For any other query, you may contact our Client Service Desk at

03-27830388 or email pcsb_enquiry@phillipcapital.com.my