Global Market Indices

Global Market Indices with Phillip Capital Malaysia

Global indices trading represents your gateway to world markets, allowing you to capture broad market movements across developed and emerging economies through a single position. At Phillip Capital Malaysia, we provide comprehensive access to major global indices including the S&P 500, FTSE 100, Hang Seng, and European benchmarks, enabling you to diversify beyond local markets and capitalize on international opportunities.

What is Global Indices Trading?

Global indices trading involves speculating on or investing in statistical measures that track the performance of specific groups of securities across international markets. Rather than selecting individual stocks, you gain exposure to entire market segments through derivatives, ETFs, or index funds that replicate index performance. This include:

S&P 500

Tracks 500 large-cap U.S. companies listed on the NYSE and NASDAQ.

Examples: Apple, Nvidia, Tesla

FTSE 100

Represents the largest publicly traded companies in the UK.

Examples: HSBC, Unilever, AstraZeneca

Hang Seng

Captures the performance of Hong Kong’s leading stocks.

Examples: Tencent, Meituan, Alibaba

Euro STOXX 50

Covers 50 blue-chip stocks across Europe.

Examples: Siemens AG, LVMH, Banco Santander

Nikkei 225

Japan’s premier stock market benchmark.

Examples: SoftBank, Nintendo, Sony Group

FTSE China A50

Tracks the top 50 A-share companies listed on the Shanghai and Shenzhen stock exchanges, providing exposure to China’s domestic economy.

Examples: Kweichow Moutai, Ping An Insurance, China Merchants Bank

Why Global Indices Trading Matters

-

Instant Market Diversification

Instead of researching individual companies across different time zones and regulatory environments, indices trading provides diversified exposure to the key sectors of an economy. A single position in the MSCI World Index, for example, gives you access to over 1,600 companies across 23 developed markets. -

Risk Management Through Geographic Spread

Global markets often move independently due to varying economic cycles, political events, and monetary policies. When Asian markets decline, European or American markets might advance, providing natural portfolio hedging.

-

Capital Efficiency

Index derivatives require significantly less capital than buying individual stocks across multiple markets. You can gain substantial market exposure while maintaining liquidity for other opportunities. -

Real-Time Market Pulse

Global indices serve as economic barometers, reflecting investor sentiment about regional growth prospects, currency movements, and geopolitical developments instantaneously.

Phillip Capital Malaysia: Your Global Trading Partner

Comprehensive Market Access

Trade major indices from Asia-Pacific, Europe, and the Americas through a single account. Monitor latest price movements across all locations from our unified platform.

Local Expertise, Global Reach

Our Malaysian base provides deep understanding of Asian market dynamics while offering seamless access to NYSE-listed products and European benchmarks.

Advanced Technology Infrastructure

Execute trades across Global markets with minimal latency, ensuring you capture price movements as they happen, regardless of your page location or time of access.

Competitive Pricing Structure

Transparent fee schedules with no hidden costs, allowing you to trade frequently without excessive transaction expenses eroding returns.

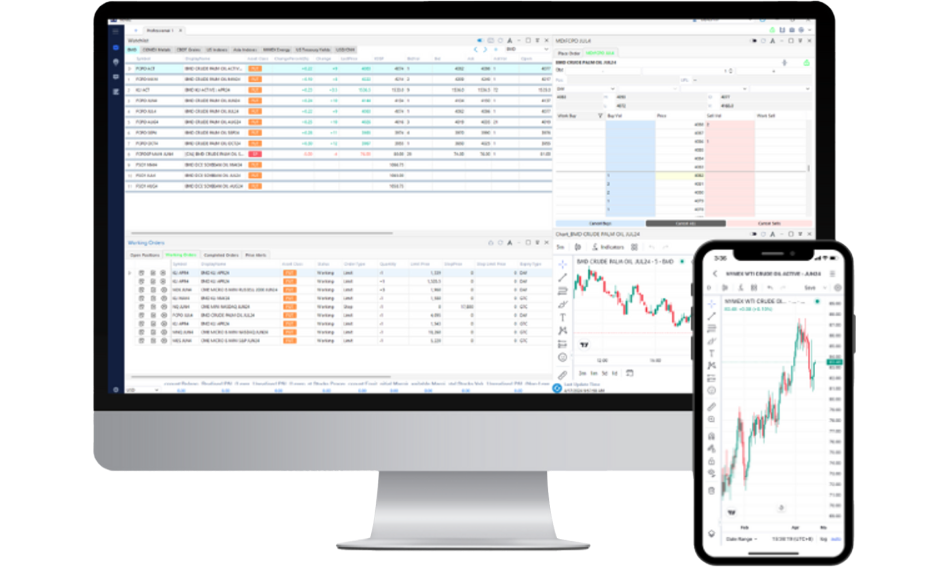

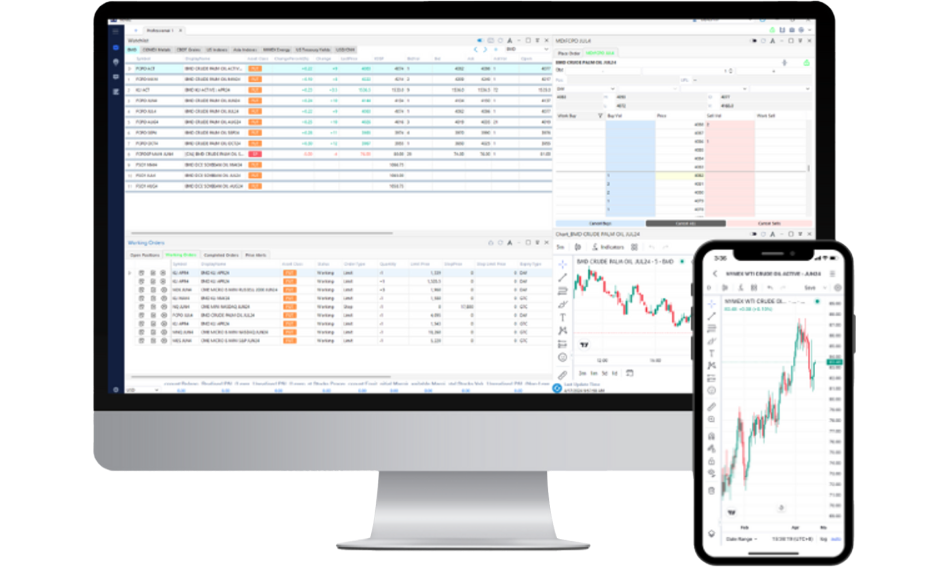

Professional Trading Platforms

Features advanced charting capabilities, simultaneous data feeds from global exchanges, and sophisticated order management tools. Perfect for active traders monitoring multiple indices simultaneously.

Access world markets from anywhere, with push notifications for price alerts and the ability to execute trades during market hours across different time zones.

No software installation required – trade directly from your browser with full functionality, ideal for accessing your account from any device or location.

Benefits of Index Trading

-

Simplified Market Participation

Rather than analyzing hundreds of individual stocks across different countries and sectors, focus on broader economic trends and market sentiment that drive index movements. -

Enhanced Liquidity

Major global indices support trillions in assets under management, ensuring tight bid-ask spreads and the ability to enter or exit positions quickly during market hours.

-

Lower Research Requirements

Index performance correlates with macroeconomic factors, central bank policies, and geopolitical events - information readily available through financial news rather than company-specific research. -

Transparent Performance Tracking

Index methodologies are publicly available, with constituent lists and weighting schemes updated regularly, providing clear visibility into your investment exposure.

Getting Started: Step-by-Step Guide

1. Account Opening

Complete our streamlined application process with required documentation. Our compliance team reviews applications promptly to minimize waiting period.

2. Platform Familiarization

Access our Phillip Nova demo environment to explore platform features, practice order placement, and understand how different order types work across various markets.

3. Market Research

Utilize our research portal to understand correlations between different indices, optimal trading hours for each market, and current economic factors affecting performance.

4. Initial Strategy Development

Start with liquid, major indices like S&P 500 before expanding to more specialized or regional benchmarks as you gain experience.

5. Risk Management Setup

Configure position sizing rules, stop-loss levels, and maximum daily loss limits before placing your first trade.

6. Trade Execution

Place orders during active market hours for optimal execution quality. Monitor how your positions perform across different zones and market sessions.

7. Performance Review

Regularly assess your trading results, adjusting strategies based on market conditions and your evolving understanding of global index behavior.

Educational Resources and Support

Comprehensive Learning Center

Access detailed guides covering index construction methodologies, factors affecting different regional markets, and advanced trading strategies specific to global indices.

Live Market Commentary

Enjoy a completely ad-free experience Key Global Indices. Major global indexes are shown immediately, along with each index's latest price, daily high, low, and % change.

Interactive Webinars

Regular sessions covering topics from basic index trading concepts to advanced portfolio hedging techniques using multiple indices simultaneously.

Dedicated Client Support

Multilingual support team available during Asian trading hours, with extended coverage during overlap periods when multiple markets operate simultaneously.

Mobile Learning Resources

Educational content optimized for mobile devices, allowing you to learn about global markets during commutes or between trading sessions.

Phillip Capital Malaysia combines local market knowledge with global trading capabilities, providing the infrastructure and support necessary to succeed in international index trading. Whether you’re hedging existing positions, diversifying portfolios, or capitalizing on global economic trends, our platform delivers the tools and resources to execute your strategy effectively across world markets.

For any other enquiries

Simply send us an email via

pcsb_enquiry@phillipcapital.com.my to make a request.