The MSCI Singapore Index (SIMSCI) ended the transition into 2026 on a high note, supported by stronger-than-expected economic data and positive analyst sentiment for its heavy-weight constituents.

Index Performance for 7 Jan 2026

The index saw a further gain of approximately +0.85%, consolidating its position above the 450 level. According to Trading Central Indicators, we are currently seeing a bullish bias for the index:

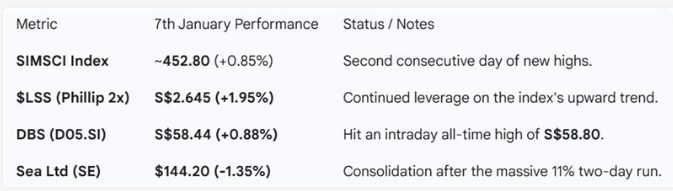

Summary of how key Singapore market products performed:

🔔 Analysis on Major Constituents

- Sea Limited (NYSE: SE)

- Analyst Upgrade: On Jan 2, Maybank upgraded Sea Ltd from “Hold” to “Buy”, maintaining a price target of $156.

- Market Reaction: The stock rose 3.3% on the news. Analysts cited the 36% pullback from 2025 highs as “overdone” and expressed confidence in Shopee’s VIP program and the upside potential of its financial arm, Monee.

- The “Big Three” Banks (DBS, OCBC, UOB)

- DBS & OCBC: Both stocks closed 2025 near record highs. Analysts noted on Jan 2 that while Net Interest Margins (NIM) will face pressure in 2026, DBS remains the best positioned due to its $78 billion in fixed-rate hedges rolling off later in the year.

- UOB: While lagging slightly behind peers due to Q3 provisions, UOB is expected to see credit costs normalize in early 2026.

- Dividends: Research published during the week confirmed expectations for 5%–6% dividend yields across the trio for FY2026.

- Digital Core REIT (SGX: DCRU)

- Strategic Win: On Jan 2, the REIT announced it had secured a 10-year agreement with a major cloud provider for its facility in Northern Virginia, significantly improving its portfolio’s weighted average lease expiry (WALE).

- Real Estate & Other News

- PropNex: Announced on Jan 2 that a high-profile lawsuit against the company had been dropped, removing a minor overhang on the stock.

💡 Investor Takeaway

Strong Singapore GDP growth continues to support confidence in key index constituents—particularly banks and domestically oriented names. In the absence of major stock-specific disruptions, the market is entering 2026 on solid fundamentals, with investor sentiment tilted toward measured optimism rather than aggressive risk-taking.

Phillip Capital’s POEMS Global MY 3.0 Platform offers a comprehensive suite of tools to support your trading journey:

- Personalised Interface: Tailor your trading environment to suit your preferences.

- Integrated Trading Tools: Access real-time analytics and live charts for informed decision-making.

- Multi-lingual Support: Benefit from assistance in various languages, catering to international investors.

Explore Phillip Capital’s platforms and tools and implement these insights effectively.