Why Isn’t My Order Filled at the Price I See?

Have you ever set a sell limit price, watched the market tick right past it, and thought, “Great, my order should be done by now!”—only to find nothing happened? You check your account again, and mysteriously, your order has expired unfilled.

Puzzled, you checked Yahoo Finance. Sure enough, the day’s high shows a price higher than your limit. So why wasn’t your trade executed?

The answer lies in the hidden details behind US market operations —where your order is routed, which exchange it reaches, and why the price you see on a consolidated tape or a price feed might not be the price available to you at that exact moment.

Unlike SGX or HKEX, which operate a single centralised exchange where all orders are routed and matched, and where market participants receive the same standardised price feed, other markets, such as the US, may have multiple venues with differing order routing and pricing mechanisms.

In this article, I’ll take you behind the scenes of order routing and explain how it works, what really happens when you click “Buy” or “Sell,” and why sometimes your order doesn’t get filled at the order price you place.

Understanding Consolidated Tape and National Best Bid and Offer

- Consolidated Tape

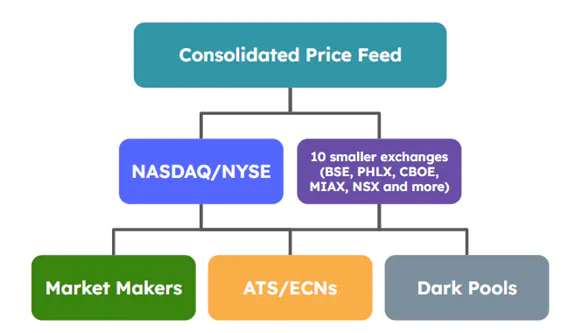

The consolidated tape is a feed that aggregates all quotes and trades from all registered exchanges. Think of it as a highlight reel of transactions happening across different venues. Below is a simple illustration:

- National Best Bid and Offer (NBBO)

From this tape, the National Best Bid and Offer (NBBO) is calculated and disseminated by Securities Information Processors (SIPs). It shows the highest available bid (buy price) and lowest available ask (sell price) across all protected US trading venues at any given moment. Under SEC Regulation National Market System (NMS), brokers must ensure client orders are executed at the NBBO or better.

Under Regulation NMS, the Rule 611 (Order Protection Rule) is designed to prevent “trade-throughs,” where orders are executed at a worse price than what is available elsewhere.

However, there are certain exceptions to this rule, such as:

- Rule 611 exemptions – Certain trades may qualify for an R6 exemption, meaning a trade can occur at a price outside the NBBO in specific situations. (e.g., blocked trades, intermarket sweep order)

- Special order types (e.g., pegged orders, midpoint orders)

- Odd-lot orders (fewer than 100 shares), which historically were not included in NBBO calculations but are now included in the SIP feed, though they may still be treated differently by some systems

How Orders Reach the Market

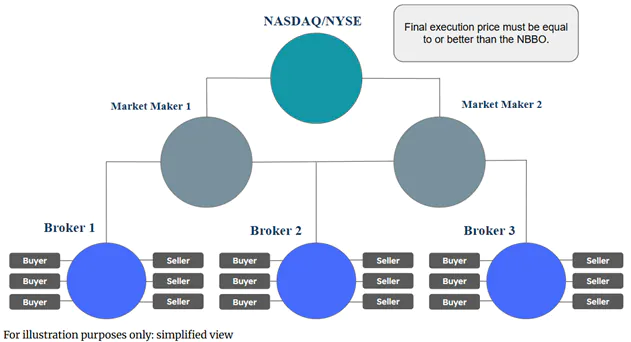

Nowadays, retail orders are never routed directly to exchanges. Instead, they are typically sent to market makers—such as Citadel Securities, Virtu Financial, Goldman Sachs, or J.P. Morgan—which may internalise the trade by filling it at a price equal to or better than the NBBO, or, if necessary, route the order to an exchange for execution if they cannot provide the required liquidity.

This also means that execution prices may vary slightly between different market makers, depending on their available liquidity, order flow, and internal pricing models. Still, US regulations require orders to be executed at a price equal to or better than the NBBO at the time of the trade, and all trades must be reported to their affiliated Trade Reporting Facility (TRF).

Why the Price You See May Differ

- Different Market Data Sources

Many brokers and news outlets use alternative market data feeds. For example, POEMS provides the NASDAQ basic price feed, quotes, and trades from NASDAQ-operated venues, not from all exchanges. As a result, prices may vary slightly from those displayed on platforms that utilize the full consolidated tape.

- Execution Venue Mismatch

Your order may be routed to a venue other than NASDAQ, such as NYSE, Cboe, or off-exchange venues like dark pools, that are not reflected in the NASDAQ basic price feed. While the NBBO ensures you still receive the best available price, the quote you’re watching may not match the venue your order reached.

- Insufficient displayed liquidity

Even if NBBO shows a certain price, the number of shares available at that price might be too small to fill your entire order, causing part or all of it to be executed at the next available price.

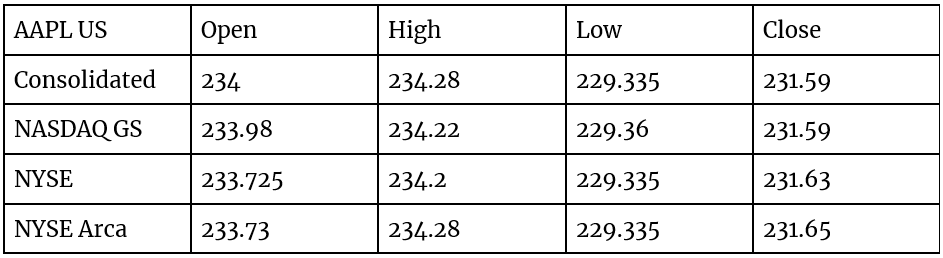

Take Apple Inc. (AAPL) as an example: its primary listing is on the NASDAQ Global Select Market (NASDAQ GS). This means NASDAQ is considered its “home” exchange for quoting and regulatory purposes.

However, trading in AAPL is not limited to NASDAQ. Orders can be executed on:

- Other national exchanges (e.g., NYSE, Cboe)

- Alternative Trading Systems (ATSs), including dark pools operated by brokers and institutions.

- Market makers (E.g., Citadel, Virtu) can internalise trades or route them to exchanges.

Regardless of where the trade is executed, it will still be reported to the consolidated tape via the SIP. This ensures the trade is reflected in the consolidated feed that forms the basis of the NBBO.

Summary Table

As shown above, the reported Open, High, Low, and Close (OHLC) values can differ slightly across exchanges because each market centre executes trades independently.

This does not mean that clients receive the worst executions. Under SEC Regulation NMS and the NBBO rule, orders must always be filled at the best price available across all venues at that moment. In this case, a venue such as NYSE Arca recorded a better price than the prevailing NBBO, which explains why it reported the highest high of the day compared to other exchanges. (Refer to the NBBO example mentioned earlier).

Conclusion

In conclusion, understanding how data such as consolidated tapes and NBBO work can give investors better clarity on how trades are executed and why prices may differ across venues. Most importantly, orders must always be filled at the best price available across all venues based on regulation.

This applies to customers trading via POEMS with us. Your orders are executed at the best available price, then, in compliance with the strict requirements of the NBBO.

We ensure that all executions meet or improve upon the best bid or offer available across all protected market centres—not just the primary exchange. Furthermore, we can provide detailed trade reports to verify that every execution is carried out in the best interest of our investors.

We hope you’re ready to enhance your trading strategy. Whether you go for the bulls or the bears, you can do it all with Phillip Capital.

Phillip Capital’s POEMS Global MY 3.0 Platform offers a comprehensive suite of tools to support your trading journey:

- Personalised Interface: Tailor your trading environment to suit your preferences.

- Integrated Trading Tools: Access real-time analytics and live charts for informed decision-making.

- Multi-lingual Support: Benefit from assistance in various languages, catering to international investors.

Explore Phillip Capital’s platforms and tools and implement these insights effectively.