Interest in US stocks has surged among Malaysian investors, driven by high-profile tech companies, global innovation, and the potential for attractive returns. From Apple and Tesla to Nvidia and Amazon, US-listed shares offer exposure to some of the world’s most valuable and dynamic businesses.

But how do you, as a Malaysian investor, tap into this exciting market?

The good news is that it’s not only legal, but also more accessible than ever. If you’re looking to build long-term wealth or actively trade on price movements, there are multiple ways to gain exposure to the US stock market.

In this guide, we explore everything you need to know about buying US shares in Malaysia, including how to start trading Contracts for Difference (CFDs) on US shares with $0 commission through Phillip Capital, a trusted, SC-regulated broker.

Key Takeaways

- Malaysians can legally invest in US shares through licensed brokers.

- US markets provide diversification, liquidity, and access to global tech leaders.

- Four main methods to buy US shares in Malaysia include custodian accounts, ETFs, CFDs, and margin financing.

- Phillip Capital offers $0 commission US Share CFDs and competitive margin financing.

- Avoid common mistakes like overleveraging, ignoring FX risks, and using unregulated brokers.

Can Malaysians Buy US Shares?

Absolutely. Malaysian investors can legally buy and trade US stocks through licensed brokers. In fact, investing internationally is an important part of a diversified portfolio.

But why are so many Malaysians turning to the US stock market?

- Exposure to Global Brands and Market Leaders

-

- The US market is home to some of the world’s most valuable and innovative companies, such as Apple, Tesla, Nvidia, Amazon, Alphabet, and so on.

- For Malaysians, investing in these stocks means tapping into global megatrends in technology, healthcare, clean energy, and AI.

- These are sectors often underrepresented in the local bourse, making the US market a more appealing long-term growth vehicle.

- Greater Liquidity and Market Depth

-

- The US stock exchanges, particularly the NYSE and Nasdaq, are the most liquid in the world.

- For investors in Malaysia, this translates to faster order execution, tighter bid-ask spreads, and more efficient price discovery.

- Whether you’re trading short-term or investing long-term, liquidity remains a critical factor.

- Diversification Beyond the Malaysian Market

-

- Relying solely on the local market exposes investors to country-specific risks, be it political, currency, or economic.

- Buying US shares allows Malaysians to diversify across geographies, sectors, and asset types.

- This helps protect portfolios from local market volatility, especially during downturns or periods of ringgit depreciation.

- Attractive Trading Promotions and Lower Barriers to Entry

-

- More brokers today are offering zero-commission CFD trading, fractional shares, and access to US-listed stocks with no minimum deposit.

- Promotions such as margin financing for US shares — like those offered by Phillip Capital — make it easier for Malaysians to gain exposure to high-priced stocks without needing to pay the full value upfront.

- These innovations have removed traditional barriers, making the US trade market accessible even to first-time investors.

- Shift in Investor Behaviour Post-Pandemic

-

- The COVID-19 pandemic accelerated digital investment adoption.

- With the rise of online platforms and mobile trading apps, many Malaysians who previously stuck to local stocks began exploring US equities.

- Platforms now offer educational resources, real-time data, and simplified user interfaces that help retail investors manage their US portfolios more easily and independently.

In short, Malaysians not only can buy US shares, but now have more reasons and resources than ever to do so. With greater access, stronger global diversification, and smarter tools offered by brokers like Phillip Capital, investing in the US market has become a straightforward process. It opens the door for more Malaysians to grow their wealth internationally.

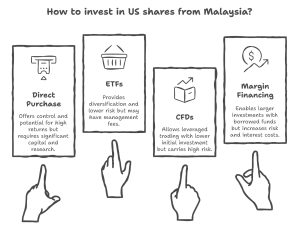

4 Ways to Invest in US Shares from Malaysia

There are several ways to invest, each catering to different goals and risk levels. Let’s look at the most common ways to access the US market and what makes each unique.

1. Direct Purchase via Custodian Account

1. Direct Purchase via Custodian Account

- How it works: You buy real shares listed on the US exchanges (like NASDAQ or NYSE), which are held in a custodian account.

- A custodian account is a brokerage account where your US shares are held securely by a licensed financial institution (the custodian) on your behalf.

- While you are the beneficial owner, the custodian is responsible for safekeeping, handling corporate actions (like dividends or splits), and ensuring compliance with regulations for international investors.

- Best for: Long-term investors who want actual ownership, access to dividends, and voting rights.

- Considerations: Typically comes with custody and platform fees, foreign exchange charges, and minimum lot sizes. Settlement time may also be longer compared to local trades.

2. Exchange-Traded Funds (ETFs)

- How it works: You buy units of an ETF listed internationally that tracks a US market index.

- An ETF is a fund traded on a stock exchange, composed of a basket of securities. US ETFs often mirror indices or specific sectors like tech, healthcare, or clean energy.

- Examples include the SPDR S&P 500 ETF Trust (SPY), the iShares Core S&P 500 ETF (IVV), and the Vanguard S&P 500 ETF (VOO).

- Buying one ETF gives you exposure to multiple companies at once.

- Best for: Passive investors aiming for diversification without needing to pick individual stocks.

- Considerations: Lower fees and reduced risk through diversification, but less flexibility in tailoring your exposure to specific companies or sectors.

3. Contracts for Difference (CFDs)

- How it works: You trade the price movements of US stocks without owning the underlying shares.

- A CFD is a derivative product that allows you to speculate on the rise or fall of share prices, profiting from both upward and downward trends.

- You don’t get ownership or dividends, but you can access leverage and trade in smaller units.

- Best for: Active traders looking for fast trades and opportunities in both rising and falling markets.

- Considerations: CFDs offer leverage and margin trading as low as 10%, which means higher potential returns but also amplified losses. Requires strong risk management and market awareness.

| 🚨 Promo Highlight: Phillip Capital now offers $0 commission trading on US Share CFDs. This is the perfect opportunity for traders seeking cost savings when making quick plays on stocks like Meta, Microsoft, or Alphabet.

Note: This zero-commission campaign is valid until 30th November only. Terms and conditions apply. |

4. Margin Financing

- How it works: You borrow funds from a broker to increase your purchasing power and buy more US shares than your cash would normally allow.

- Margin financing lets you amplify your position by using borrowed money secured against your investment portfolio.

- For example, with RM10,000, you might be able to buy up to RM20,000 worth of US stocks.

- Best for: Experienced investors who are confident in their strategy and want to boost their exposure.

- Considerations: Margin increases your buying power, but also your downside risk. Markets can be volatile, and falling share prices can trigger margin calls.

| 🚨 Promo Highlight: With Phillip Capital’s Margin Financing Campaign, Malaysians now have easier access to leveraged investing in US-listed shares at competitive rates that help open bigger opportunities in global markets.

Enjoy promotional margin financing rates with 0% rollover fees, stamp duty reimbursement, and an RM100 Touch ’n Go eWallet reward, available for a limited time until 28th February 2026! |

Each route offers different advantages depending on your investment style and risk appetite. Whether you’re looking to own US blue-chip stocks, diversify through ETFs, actively trade with CFDs, or leverage your capital via margin financing, Malaysians today have more access than ever to the global equity space. The key is understanding the tools and choosing what fits your goals.

How to Get Started on Trading US Shares in Malaysia With Phillip Capital

Here’s how you can start your journey into the US markets with Phillip Capital:

- Open a Phillip Capital Trading Account

Sign up via the Phillip Capital website. Select whether you want to trade CFDs, real shares, or futures

- Verify Your Identity

Upload your IC, proof of address, and relevant financial documents.

- Fund Your Account

Transfer MYR and convert to USD via the platform’s FX options.

- Choose Your Product

- For short-term trading, use US CFDs with $0 commission.

- For long-term investing, explore margin financing for direct share purchase.

- Start Trading via Phillip Nova or TradingView

Access real-time US market data, charts, and order execution tools via multi-platform access.

Starting your US investing journey with Phillip Capital is a seamless process tailored for both new and experienced investors. With clear steps, multi-platform access, and product options suited to various trading styles, Malaysians can now participate in the global stock market with confidence and convenience.

Common Mistakes to Avoid When Buying US Shares

While access to US markets is easier than ever, many Malaysian investors still fall into avoidable traps that can cost them money or confidence. Whether you’re trading CFDs or investing in real shares, avoiding these common pitfalls will put you on a better path toward success.

- Not Understanding the Product

-

- Some investors jump in without knowing whether they’re trading a CFD or buying actual shares.

- This misunderstanding can lead to poor decision-making, especially around holding periods, dividends, and capital gains.

- CFDs are typically used for short-term trades and do not grant shareholder rights, while real shares are better suited for long-term portfolio growth.

- Ignoring Currency Risks

-

- When trading US shares, your capital is exposed to USD-MYR fluctuations.

- Even if the share price rises, currency depreciation can eat into your returns.

- It’s important to monitor exchange rates and consider hedging strategies or using platforms that allow efficient FX conversions.

- Overleveraging with Margin

-

- Margin trading allows you to amplify gains, but it also magnifies losses.

- Many beginners use margin without fully understanding the risk.

- Always calculate your exposure and make sure you have enough buffer in case the market moves against your position.

- Never borrow more than you can afford to lose.

- Trading Without a Plan

-

- Having no strategy is one of the fastest ways to lose money.

- Whether you’re aiming for short-term gains or long-term growth, define your entry, exit, stop-loss, and risk tolerance beforehand.

- Avoid emotional decisions by sticking to a well-researched plan.

- Choosing Unregulated Platforms

-

- Unlicensed brokers may offer attractive perks but come with significant risks, including a lack of investor protection and transparency.

- Always verify that your broker is regulated by the Securities Commission Malaysia (SC) to ensure your funds and trades are safeguarded.

Mistakes are part of the learning process, but some can be avoided with the right guidance and preparation. By taking the time to understand the instruments, managing your risks, and using a licensed broker like Phillip Capital, you’ll be in a better position to make smart, confident investment decisions in the US markets.

Jumpstart Your US Investing Journey Today

Buying US shares from Malaysia is not only possible but highly accessible with the right broker. If you’re looking to build a long-term portfolio or execute short-term trades, Phillip Capital gives you the tools, access, and support you need.

With $0 commission US Share CFDs and attractive margin financing for US stocks, now is the perfect time to tap into the world’s most exciting market.

Ready to trade smarter? Check out Phillip Capital’s promotions or open a free demo account to get started today.