Introduction: Why Tax Efficiency Matters in Global ETF Investing

Diversification is the foundation of a resilient investment portfolio. However, beyond selecting the right mix of ETFs across markets and sectors, investors must also consider portfolio efficiency. particularly how much of their returns are lost to taxes.

For Singapore-based investors, capital gains are not taxed, which is a clear advantage. However, dividend withholding tax remains a drag for portfolio performance, especially when investing in foreign-domiciled ETFs. With dividend yields potentially forming a significant portion of long-term returns, even a small reduction in tax can lead to meaningful differences over time.

In this article, we explore:

- What dividend withholding tax is and how it affects your returns

- How Ireland-domiciled ETFs offer a more tax-efficient alternative to US-domiciled ETFs

- Common ETF investing mistakes and how to avoid them

By understanding these nuances, investors can better optimise their portfolios, focusing not only on diversification but also on net performance after fees and taxes.

What Is Dividend Withholding Tax?

When companies pay out dividends, certain jurisdictions impose a withholding tax before the dividend reaches investors. This tax is deducted at source, meaning investors receive a reduced net payout regardless of their home country’s tax rules.

Let’s take an example.

- VOO (Vanguard S&P 500 ETF) is domiciled in the United States and has a dividend yield of approximately 1.18%.

- For Singapore-based investors, U.S. tax rules impose a 30% dividend withholding tax.

- This reduces your actual dividend income, increasing your total cost of ownership despite the ETF’s low expense ratio (0.03%).

- After factoring in withholding tax, the effective total fees becomes roughly 0.384% annually.

Bottom Line: The hidden cost of dividend tax can erode returns significantly—particularly for income-focused portfolios.

How Ireland-Domiciled ETFs Reduce Tax Leakage

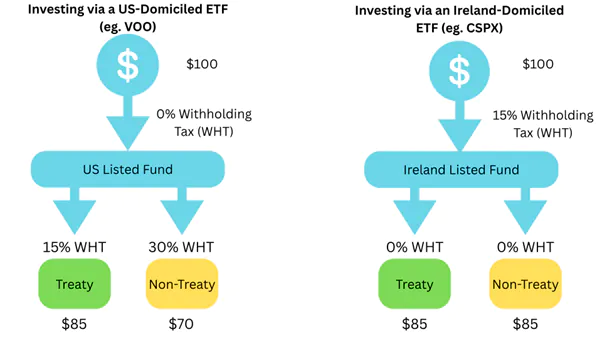

To improve after-tax returns, investors can consider Ireland-domiciled ETFs, such as CSPX (iShares Core S&P 500 UCITS ETF). These ETFs enjoy favorable tax treaties with the US, reducing the dividend withholding tax to 15%, which is half the rate applied to the US-domiciled equivalents like VOO.

Understanding the tax levels helps clarify the advantage:

- Investment Level: Tax levied on dividends paid from underlying companies to the fund

- Fund Level: Tax applied on dividends the fund pays to investors (depends on fund domicile)

- Investor Level: Applicable taxes based on where the investor resides

By choosing the right fund domicile, investors legally reduce tax drag and retain a higher share of their dividend income, thereby improving total portfolio efficiency.

Common Pitfalls to Avoid in Global ETF Investing

1. Overlapping Exposure

Investors often unintentionally hold multiple ETFs that track the same index, assuming it adds diversification.

For example:

- VOO (US.-listed) and CSPX (Ireland-domiciled) both track the S&P 500.

- Holding both does not offer added diversification but may increase tax inefficiency due to differing withholding tax rules.

Tip: Select one based on your dividend strategy and tax considerations. Doubling up provides no performance advantage and adds unnecessary cost complexity.

2. Overexposure to Thematic ETFs

Thematic ETFs, such as those focusing on AI, robotics, clean energy, or blockchain—offer concentrated exposure to high-growth areas. However, they come with greater volatility and often lack broad diversification.

Excessive allocation to these themes can make portfolios overly sensitive to cyclical swings or speculative trends.

Tip: Use thematic ETFs as satellite positions, ideally no more than 10–15% of your total portfolio. Anchor your strategy around broad-market ETFs (e.g., CSPX, IWDA) to maintain balance and consistency.

3. Ignoring Portfolio Drift

Even if individual ETFs rebalance internally, your overall asset allocation can shift over time—especially when one sector or region outperforms.

For instance, if your US equity ETFs outperform bond holdings for several quarters, your equity exposure may rise significantly—increasing your portfolio’s risk level without you noticing.

Tip: Review your portfolio semi-annually or annually. Rebalance by adjusting new contributions or reallocating excess gains to bring your allocations back to your target mix. This discipline prevents overexposure and aligns your strategy with your long-term goals.

Conclusion: Turning Good Portfolios into Great Ones

Building a diversified ETF portfolio is just the starting point. Long-term success depends on refining that portfolio for tax efficiency, disciplined allocation, and risk control. Singapore investors—who already enjoy a tax-friendly environment—can go even further by:

- Using Ireland-domiciled ETFs to reduce dividend withholding tax

- Avoiding unnecessary duplication in ETF exposure

- Allocating to thematic opportunities with measured discipline

- Rebalancing regularly to maintain strategic alignment

Every fraction of a percentage point saved in taxes or costs compounds over time. In the world of investing, it is not only what you own that matters—it is how you structure, monitor, and adapt your portfolio that determines whether you simply meet your goals or surpass them.

We hope you’re ready to enhance your trading strategy. Whether you go for the bulls or the bears, you can do it all with Phillip Capital.

Phillip Capital’s POEMS Global MY 3.0 Platform offers a comprehensive suite of tools to support your trading journey:

- Personalised Interface: Tailor your trading environment to suit your preferences.

- Integrated Trading Tools: Access real-time analytics and live charts for informed decision-making.

- Multi-lingual Support: Benefit from assistance in various languages, catering to international investors.

Explore Phillip Capital’s platforms and tools and implement these insights effectively.