Introduction: Why Diversification Is Essential in 2025

We introduced a tiered investment strategy tailored for Singaporean investors, starting with foundational domestic ETFs and scaling up to include global and thematic exposures. As markets continue to navigate volatility from rate shifts, geopolitical tensions, and sectoral rotations, investors are asking: How can I ensure my portfolio is both resilient and growth-oriented?

For this article, we take the conversation further by addressing:

- How to construct a truly diversified ETF portfolio across sectors and geographies

- What diversification really means and why it matters

- Who benefits most from diversified strategies

- How to structure a global ETF allocation effectively

What Is Diversification?

Diversification is a core investment principle used to manage risk and enhance long-term returns. Instead of relying on the performance of a single stock, sector, or country, it spreads investments across a variety of assets. This reduces the impact of any single underperforming asset class on your overall portfolio.

In simple terms:

“Don’t put all your eggs in one basket.”

By allocating across different sectors (e.g. banking, technology, healthcare), asset classes (e.g. equities, bonds), and markets (e.g. Singapore, US, Asia), you lower the chances of your entire portfolio declining during a downturn in any single area.

Who Should Diversify—and Why?

While all investors can benefit from diversification, it is especially important for those who may be unknowingly overexposed to a particular risk factor. This includes:

- Investors heavily concentrated in specific sectors

E.g. portfolios consisting mainly of banking or tech stocks, which can be cyclical or sensitive to regulatory risk. - Investors with home country bias

E.g. those who allocate nearly 100% of their capital to Singapore-listed equities, which may lack exposure to global trends like AI, healthcare innovation, or emerging markets growth.

Diversification doesn’t mean abandoning local investments—it means complementing them with assets that behave differently in varying market environments.

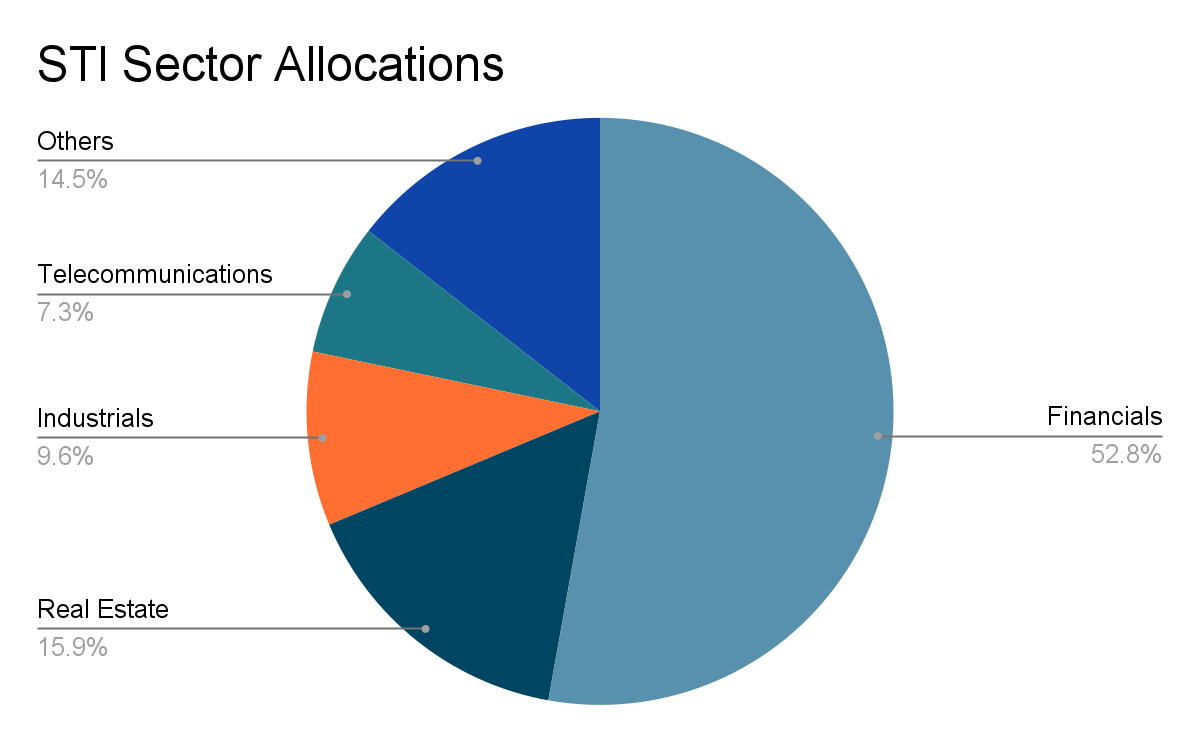

Case Study: Portfolio Concentration in the STI

Singapore’s benchmark Straits Times Index (STI) consists of 30 constituents, yet remains heavily concentrated in a few sectors—approximately 53% in financials, primarily banks. While these are blue-chip with sound fundamentals, and consistent dividend-paying stocks, the index lacks sector diversity.

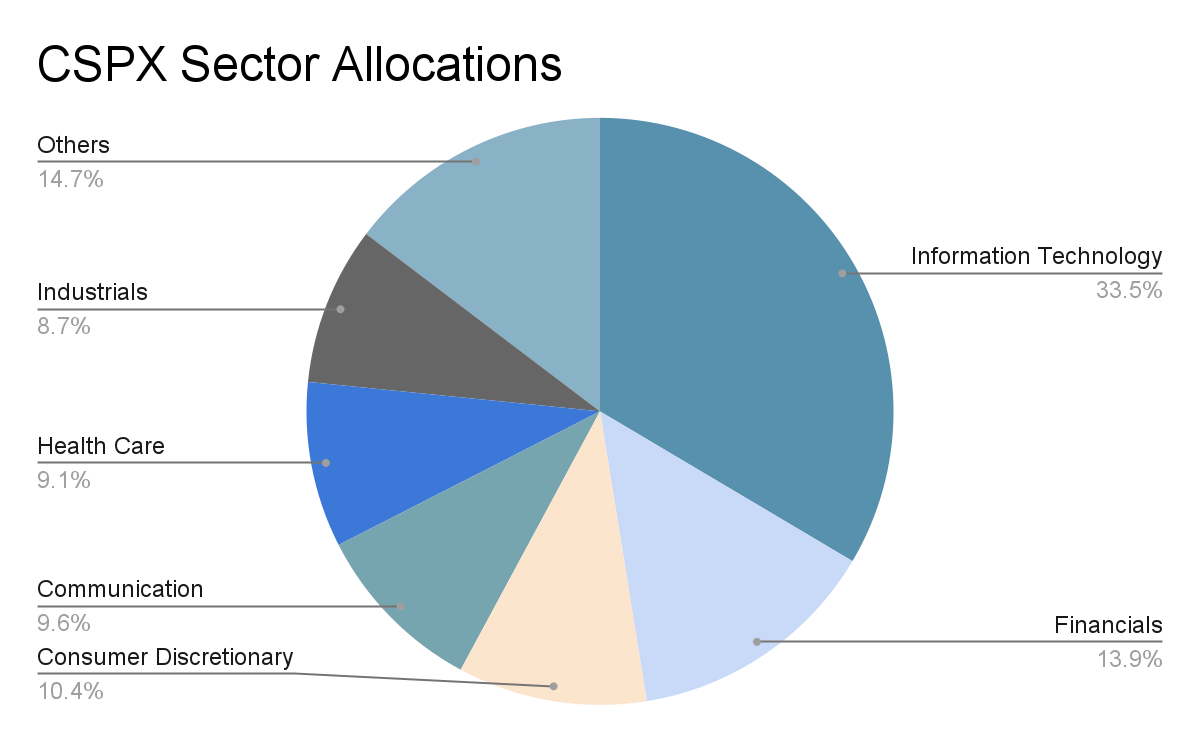

To mitigate this concentration, global ETFs such as CSPX (S&P 500) can be added. CSPX holds U.S. equities across tech, healthcare, consumer goods, and more—providing exposure to high-growth sectors not represented in Singapore.

Sample Diversified Portfolio Allocation

Here’s how investors might structure their portfolios to balance local strength with global opportunity:

| Region | Allocation | ETF Examples |

| Singapore Core | 50% | 40% ES3 (STI), 10% MBH (SGD Bonds) |

| US Diversification | 40% | CSPX (S&P 500 Index) |

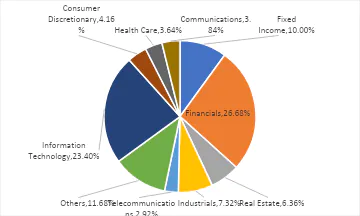

| Thematic Growth | 10% | SOXX (Semiconductors) |

This structure allows investors to:

- Retain exposure to local blue-chip dividend payers (e.g. banks, REITs)

- Add global large-cap growth stocks (via CSPX)

- Capture thematic trends (via SOXX for AI chips)

Historically, the US market has outperformed in capital appreciation, while Singapore equities provide higher yields and lower volatility. Combining the two creates a more balanced total-return profile.

Other examples could include an ETF with exposure into emerging markets such as ASEAN or ETF with Asia Pacific (APAC) exposure.

Conclusion: Build Global Resilience from a Singapore Core

Diversification isn’t just about owning more ETFs—it’s about owning the right mix across markets, sectors, and asset classes. Whether you’re looking to stabilize income, access high-growth global themes, or reduce reliance on local sectors, diversification is the tool to future-proof your investment strategy.

A simple start for self-evaluation would be asking:

- Are you too concentrated in a single market or sector?

- Does your portfolio reflect global growth drivers like technology, healthcare, or emerging markets?

Building Your ETF Watchlist

Some ETFs mentioned in this article include:

- ES3 – Singapore’s STI Index

- MBH – Singapore Corporate Bond ETF

- CSPX – S&P 500 (Ireland-domiciled)

- SOXX – USSemiconductor ETF

As always, align your ETF picks with your time horizon, risk tolerance, and financial goals. Diversification works best when applied with clarity and consistency.

Stay tuned for our next feature, where we explore how to be more tax efficient as well as avoid common pitfalls in selecting ETFs.

We hope you’re ready to enhance your trading strategy. Whether you go for the bulls or the bears, you can do it all with Phillip Capital.

Phillip Capital’s POEMS Global MY 3.0 Platform offers a comprehensive suite of tools to support your trading journey:

- Personalised Interface: Tailor your trading environment to suit your preferences.

- Integrated Trading Tools: Access real-time analytics and live charts for informed decision-making.

- Multi-lingual Support: Benefit from assistance in various languages, catering to international investors.

Explore Phillip Capital’s platforms and tools and implement these insights effectively.