When people hear “derivatives,” or “futures trading”, their eyes sometimes glaze over. But fret not, it’s not as complicated as it sounds. Derivatives / Futures trading are just financial contracts that get their value from an underlying asset, like a stock index, gold, or even palm oil. And if you’re a Malaysian trader or investor looking to expand your portfolio, BMD is where things start to get interesting.

Bursa Malaysia Derivatives (BMD) is the country’s primary exchange for futures and commodities trading in Malaysia, offering a range of products tailored to the local market. From palm oil to stock indices and gold, BMD provides access to instruments that can help you hedge risk, speculate on price movements, or simply diversify your exposure.

So, what exactly can you trade on BMD?

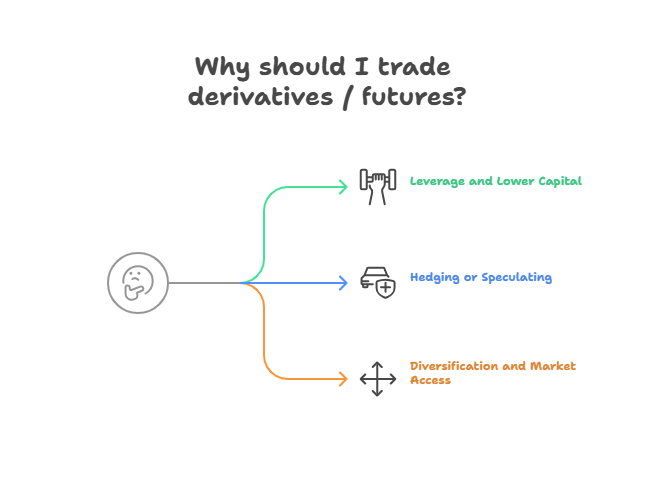

Why Trade Derivatives / Futures?

Let’s start with the big question: Why bother with derivatives / futures at all? Here are a few reasons:

✅ Leverage and Lower Capital Requirement

Futures let you control a large position with a relatively small amount of capital. This means greater exposure with less upfront cost BUT it also means higher risk, so managing it wisely is key.

✅ Hedging or Speculating

You can use futures to hedge existing positions or speculate based on market trends. This flexibility makes futures trading in Malaysia appealing to both conservative and aggressive investors.

✅ Diversification and Market Access

Want exposure to palm oil, gold, or the KLCI index? Futures let you tap into these markets without the need to own physical commodities or a basket of stocks.

⚠️ Risks to Consider⚠️With high potential comes high volatility. Leverage can amplify both profits and losses. That’s why working with an experienced broker and understanding margin requirements is crucial. |

What Can You Trade on Bursa Malaysia Derivatives?

Here are some of the most actively traded contracts on the exchange:

| 🟡 FCPO – Crude Palm Oil Futures | 📉 FKLI – FTSE Bursa Malaysia KLCI Futures | 🥇 FGLD – Gold Futures | |

| The Basics | Malaysia is one of the world’s largest producers of palm oil. So, it’s no surprise that FCPO is among the most popular products in commodity trading in Malaysia. | The FKLI tracks the performance of Malaysia’s top 30 listed companies and is a go-to instrument for futures Malaysia equity investors. | Want to trade gold without storing physical bullion? FGLD allows you to access gold markets in Ringgit. |

| Who? | Plantation companies, exporters, and speculators looking to capitalise on price movements. | Traders who want to hedge their equity portfolio or speculate on the general market trend. | Investors looking for a hedge against inflation or market uncertainty. |

| Why? | As a globally relevant commodity, palm oil prices are influenced by supply, demand, weather, and global economic trends. | Offers an efficient way to get market exposure without buying individual stocks. | Great for local investors as it’s denominated in MYR. |

| Contract Specs | Lot size: 25 metric tonnes

Tick size: RM1 = RM25 Monthly contract listings available |

RM50 per index point

Tick size: 0.5 index points (RM25) |

Contract size: 100 grams

Priced in RM/gram Tick size: RM0.05 (RM5) |

How to Start Trading BMD Products with Phillip Capital

If you’re ready to dive in, the first step is to open a futures trading account in Malaysia, and Phillip Capital makes the process smooth and beginner-friendly.

📝 Open Your Account

To open a trading account in Malaysia, you’ll need:

✅ A copy of your IC/passport

✅ Fund in minimum RM1,000

✅ Completion of a basic suitability assessment

💰 Margin Requirements

Each contract has a different initial margin requirement. Don’t worry, Phillip Capital provides clear guidance so you’ll know how much capital you need to start.

🧰 Tools & Platforms

Through Phillip Capital, you’ll get access to Phillip Nova and you’ll get:

- Intuitive dashboards

- TradingView chart integration

- Real-time pricing

- Seamless execution for futures and commodities trading in Malaysia

🎓 Learn as You Go

Phillip Capital provides free webinars, tutorials, and educational guides to help new traders understand the mechanics and strategies of trading futures in Malaysia.

Why BMD Is Relevant for Malaysian Traders

Trading locally makes sense for a few reasons:

- Products are tailored to Malaysia’s economy (e.g., palm oil, KLCI).

- Ringgit-denominated contracts make it easier to manage currency risk.

- BMD is regulated by Securities Commission Malaysia, offering transparency and security.

- Trading hours are aligned with local business days—making it convenient.

Get Access to the Best Tools

From crude palm oil to gold, Bursa Malaysia Derivatives offers a versatile set of instruments to help you hedge, speculate, or diversify.

Whether you’re a beginner testing the waters or a seasoned trader, working with an established broker like Phillip Capital gives you access to tools, education, and support every step of the way.

Open a futures trading account in Malaysia with Phillip Capital today and explore new opportunities in futures and commodity trading in Malaysia.