The SiMSCI Index (SGX MSCI Singapore Free Index) Futures contract is the most liquid equity index futures on SGX, offering exposure to Singapore’s large- and mid-cap stocks. Comprising of 17 constituents and covering about 85% of the market’s free float-adjusted capitalisation, the index is anchored by DBS, OCBC, UOB, Singtel, Sea Ltd, and Grab.

In 2025, the contract has drawn strong attention. As of 26 August, the SiMSCI posted a total return of +23.35% YTD in SGD terms, comfortably outperforming the Straits Times Index (STI), which gained +16.64% YTD. The STI itself reached an all-time high of 4,282.80 on 14 August, underscoring the resilience of Singapore equities.

From a macro lens, the outlook remains constructive. Singapore’s equity market benefits from a unique blend of compelling valuations, strong sovereign fundamentals, and supportive policy initiatives. These factors reinforce its role as a safe-haven destination within Asia.

Valuations stand out as a key driver. The SiMSCI trades at 16.6x LTM P/E, representing a ~40% discount to the S&P 500’s 27.5x and below its own five-year average of 18.0x. This relative and absolute discount strengthens the case for re-rating, particularly when combined with a 12-month dividend yield of ~3.8%.

Fundamentals also remain robust. Singapore is the only AAA-rated sovereign in Asia, with reciprocal tariffs capped at just 10% — among the lowest in the region. Such strengths provide insulation against global market shocks and currency volatility, helping sustain investor confidence.

Policy support is another tailwind. The Monetary Authority of Singapore (MAS) recently announced a S$5bn Equity Market Development Program to deepen liquidity and broaden institutional participation. At the same time, local corporates are becoming more shareholder-friendly, with rising dividends and share buybacks enhancing returns.

For investors seeking growth exposure, the SiMSCI is particularly appealing. Bloomberg factor data shows the index tilts more toward growth and volatility compared to the STI, making it a preferred instrument for higher-beta strategies.

On the rates front, falling borrowing costs should further support equity valuations. We expect the 3M-SORA to decline as the Federal Reserve embarks on rate cuts. Risks remain, including potential volatility if Fed independence is challenged politically, but Singapore’s safe-haven profile should limit downside.

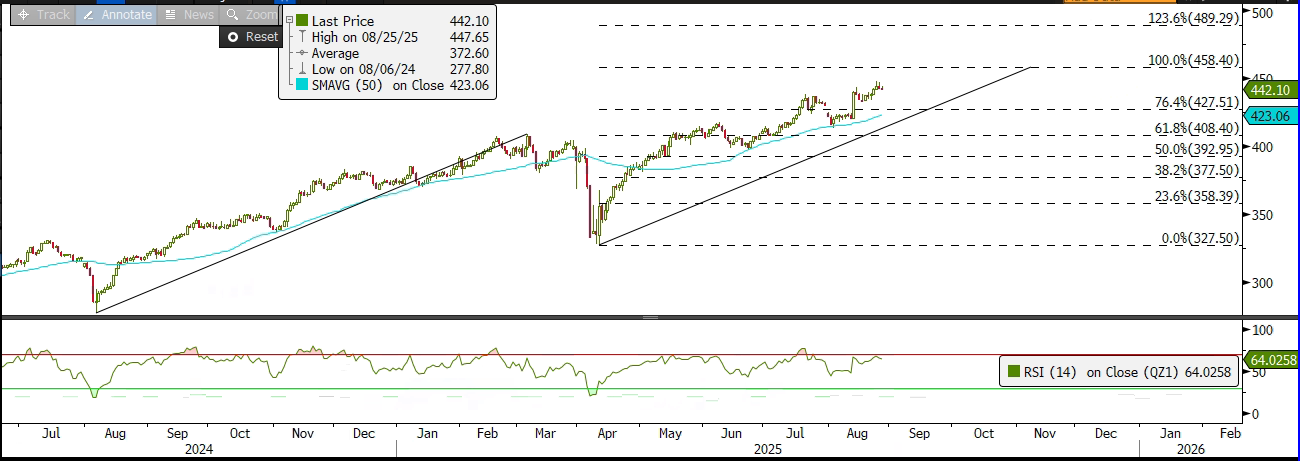

Technical Outlook

Technically, momentum favors the bulls. The SiMSCI rebounded from its April low of 327.50 and broke above the 76.4% Fibonacci extension in August, propelled by a sharp rally in Sea Ltd’s shares (+19% in a single session). A sustained breakout above 460 could open the path to 490 — the 123.6% Fibonacci extension level and our year-end target.

Support lies at the 50-day moving average near 420, providing a strong technical floor. While RSI levels suggest short-term consolidation is possible, the broader trend remains constructive, underpinned by earnings strength, macro resilience, and policy catalysts.

With attractive valuations, safe-haven fundamentals, and bullish technical signals, the SiMSCI Index Futures continues to shine as the preferred vehicle for investors seeking both defensive stability and growth exposure in Singapore’s equity market.

Add these bubbling Singapore market opportunities into your watchlist now!

Trade the SGX MSCI Singapore Index Futures (SGP) at only SGD3.88 on Phillip Nova 2.0 now!

Or take a view in the robust Asian markets with SGX Asian Index Futures (CN, FCH, MTWN, TWN, FID, and FVN) from as low as USD1.88 commission. Learn more now!

How to Open an Account and Get Started

Ready to start? Here’s how to open an account with Phillip Nova and connect it to TradingView:

- Visit http://www.phillip.com.my

- Click “Open an Account” and choose “futures’ as your account type.

- Complete your registration and KYC verification.

- Log into your TradingView account, search for Phillip Nova under brokers, and link your account.

- Subscribe to live market data on TradingView for the instruments you want to trade.

Once set up, you’re ready to trade BMD, SGX futures and commodities futures — all from one powerful interface.

Experience Modern Trading Today

Whether you’re trading FCPO futures on TradingView, gold, or other global futures, the integration of Phillip Nova on TradingView delivers a modern trading experience that combines speed, flexibility, and powerful analytics.

With low commissions, professional-grade tools, and multi-market access, it’s a smarter, more efficient way to trade. And with the trusted name of Phillip Capital behind it, you can trade with confidence.

Ready to trade smarter and faster? 👉 Open a Phillip Nova account today and link it to TradingView to unlock the future of trading — all on one screen.