Crude palm oil (CPO) is more than just a cooking staple in Malaysia; it’s one of the backbones of our economy. As the second-largest producer and exporter of palm oil globally, Malaysia plays a significant role in shaping the direction of this commodity’s market.

For traders and investors, this also means that crude palm oil futures (FCPO) present an exciting opportunity to be part of something big.

In fact, FCPO is one of the most actively traded contracts on Bursa Malaysia Derivatives (BMD), attracting everyone from palm oil producers to retail investors.

But if you’re just starting out, no worries! We will break down everything you need to know about how to trade FCPO, even if you’re completely new to the game.

What is FCPO?

Let’s get the basics right. FCPO stands for Crude Palm Oil Futures, a derivative contract listed on Bursa Malaysia Derivatives. These contracts allow buyers and sellers to agree today on a price for crude palm oil to be delivered at a future date.

The purpose? FCPO allows participants to hedge against price volatility, speculate on price movements, or simply gain exposure to the palm oil market, all without touching a single oil palm tree.

Here are the key contract specifications:

- Contract size: 25 metric tonnes of crude palm oil

- Tick size: RM1 movement equals RM25 per contract

- Trading months: Monthly contracts available up to 24 months ahead

- Settlement: Physically delivered

Knowing these basics helps set you up for trading with confidence. But understanding how to trade FCPO successfully requires more than memorising numbers — you need to know the players and the forces at play.

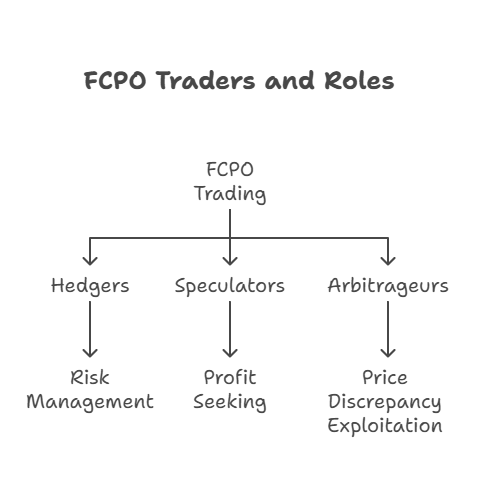

Who Trades FCPO and Why?

|

1. HedgersThese are usually big players like plantation companies, exporters, or refiners. They use FCPO to lock in prices and manage risks. For example, a palm oil producer might sell FCPO contracts to protect against a potential drop in CPO prices. 2. SpeculatorsThis group includes retail investors, proprietary traders, and institutions. They don’t own palm oil but want to profit from price movements — buying low and selling high (or vice versa). With the rise of Malaysia’s online invest trading, it’s easier than ever for individuals to join in. 3. ArbitrageursThey take advantage of price differences between the futures and physical markets. It’s a more advanced strategy, but it adds liquidity and efficiency to the market. |

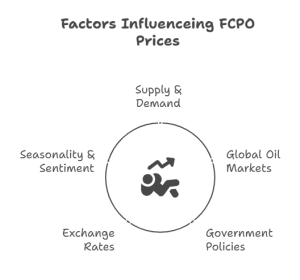

What Moves FCPO Prices?

To master how to trade FCPO successfully, it’s crucial to understand what makes prices move:

- Supply & Demand: Weather conditions, harvesting cycles, and export numbers all matter.

- Global Edible Oil Markets: Prices of soybean oil, sunflower oil, and other alternatives often influence CPO prices.

- Government Policies: Biodiesel mandates or export taxes in Malaysia can significantly impact the market.

- Exchange Rates: Especially MYR/USD. Since palm oil is traded globally in USD, currency strength matters.

- Seasonality & Sentiment: Just like any commodity, palm oil has its high and low seasons.

How to Start Trading FCPO with Phillip Capital

If you’re ready to jump in, here’s a quick walkthrough of how to trade FCPO with Phillip Capital, one of Malaysia’s most trusted names in futures trading.

Step 1: Open a Futures Trading Account

Start by opening an account with Phillip Capital. The onboarding process is streamlined and guided by our licensed dealer representatives.

Step 2: Understand Margin & Trading Hours

You’ll need to maintain an initial margin to start trading. Think of it as a deposit. FCPO trading hours typically run from 10:30 am to 6:00 pm, with a break in between.

Step 3: Fund Your Account

Once you’re ready, transfer the required funds to your trading account. Easy and secure.

Step 4: Access the Phillip Nova Platform

Trade using Phillip Nova, our online futures trading platform in Malaysia. Users love it for its power and simplicity. It’s fully integrated with TradingView, so you get real-time charts, technical indicators, and all the tools you need.

Step 5: Try a Demo First

Not ready to go live? No problem. Practice with a demo account and attend our educational webinars to learn how to trade FCPO successfully in real market conditions.

Why Trade FCPO with Phillip Capital?

We offer confidence. Here’s what sets us apart:

- ✅ #1 Futures Broker in Malaysia – Awarded by Bursa Excellence Awards 2024

- ✅ Local Expertise – Deep understanding of Malaysia’s commodity markets

- ✅ Powerful Tools – Our Phillip Nova platform comes with TradingView charting integration

- ✅ Education First – Join regular seminars and webinars to stay on top of market trends

- ✅ Personalised Support – Get one-on-one coaching from our licensed dealer representatives

- ✅ Nationwide Presence – We have 11 Phillip Investor Centres across Malaysia

Want to Diversify? Try Crude Oil Futures Too

Once you’ve mastered FCPO, why not expand your horizons? Many traders are now learning how to trade crude oil futures to gain exposure to the global energy market. The principles are similar: futures trading, supply and demand analysis, and technical setups, but with a worldwide twist.

Get Involved in One of Malaysia’s Most Vital Industries

Trading crude palm oil futures is a smart way to get involved in one of Malaysia’s most important industries. Whether you’re looking to hedge risks or explore new profit opportunities, FCPO offers a structured, regulated, and dynamic market.

Within a single platform, Phillip Capital gives you the tools, knowledge, and support you need to trade with confidence. So what are you waiting for? Open a futures trading account with Phillip Capital today and tap into the power of Malaysia’s palm oil market.