In the dynamic world of investing, understanding market trends is crucial for making informed decisions. Two primary market conditions—bullish and bearish—significantly influence trading strategies and investment outcomes. Recognising these trends and adapting accordingly can enhance your trading performance, especially when doing online trading in Malaysia or exploring how to buy US stock in Malaysia.

Understanding Market Trends: Bullish vs. Bearish

| Bullish Market Characterised by rising prices and investor optimism. | Bearish Market Involves declining prices and investor pessimism. |

| Positive Economic Indicators: Rising GDP, strong corporate earnings, and increased consumer spending signal economic growth. | Negative Economic Indicators: Falling GDP, declining corporate profits, and rising unemployment suggest economic downturns. |

| Investor Confidence: High levels of investment and market participation reflect positive sentiment. | Investor Caution: Reduced investment activity and increased selling pressure are common. |

| Sector Performance: Growth-oriented sectors like technology and consumer goods often lead in bullish markets. | Defensive Sectors: Industries like utilities, healthcare, and commodities such as gold tend to perform better during bearish phases. |

| Bullish Patterns: Technical signals such as breakout charts and moving average crossovers are common bullish patterns used by traders. | Bearish Strategy: Investors often deploy a bearish strategy involving short-selling or shifting to defensive stocks during market downturns. |

Key Indicators to Spot a Bullish or Bearish Market

| Bullish Indicators Economic Growth: An expanding GDP indicates a healthy economy. Corporate Earnings: Consistent profit growth among companies boosts investor confidence. Technical Signals: Upward trends in moving averages and breakout patterns suggest bullish momentum. | Bearish Indicators Economic Contraction: A shrinking GDP points to economic challenges. Rising Unemployment: Higher jobless rates can dampen consumer spending and corporate profits. Technical Signals: Patterns like the ‘death cross,’ where the 50-day moving average falls below the 200-day average, indicate potential bearish trends. |

Trading Strategies for Bullish Markets

- Long Positions: Buying stocks or futures with the expectation of price increases.

- Momentum Trading: Capitalising on upward trends by investing in high-performing stocks.

- Growth Investing: Focusing on companies with strong potential for future earnings growth.

- Options and Derivatives: Utilising call options to benefit from anticipated price rises.

Trading Strategies for Bearish Markets

- Defensive Stocks: Investing in sectors less affected by economic downturns, such as healthcare and utilities.

- Hedging: Using options, futures, or inverse ETFs to mitigate potential losses.

- Value Investing: Identifying undervalued companies with strong fundamentals that are likely to recover post-downturn.

Bearish Strategy: Employing techniques such as short-selling or buying put options to profit from market declines.

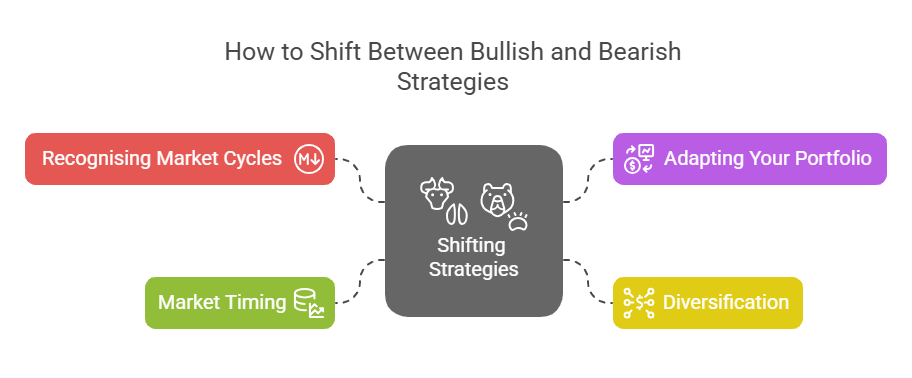

How to Shift Between Bullish and Bearish Strategies

- Recognising Market Cycles: Understanding the phases of market cycles helps in anticipating trend reversals.

- Adapting Your Portfolio: Rebalancing investments to align with current market conditions ensures resilience.

- Market Timing: Strategic asset reallocation depends heavily on reading economic signals and market timing.

- Diversification: Spreading investments across various asset classes reduces risk during market fluctuations.

Risk Management in Bullish and Bearish Markets

- Stop Losses and Take Profits: Setting predetermined exit points protects against significant losses and secures gains.

- Position Sizing: Allocating appropriate capital to each trade based on risk tolerance and market conditions.

- Regular Monitoring: Staying informed about market indicators and news ensures timely decision-making.

- Timing the Market: While it’s difficult to perfect, understanding and timing the market can help mitigate risks during market dips.

Develop Your Most Effective Trading Strategies

Understanding whether the market is bullish or bearish is fundamental to developing effective trading strategies. By recognising key indicators and adapting your approach, you can navigate market trends with greater confidence.

Whether you’re interested in trading US stock in Malaysia or looking for guidance on timing the market during market dips, a solid strategy tailored to current conditions is essential.

We hope you’re ready to enhance your trading strategy. Whether you go for the bulls or the bears, you can do it all with Phillip Capital.

Phillip Capital’s POEMS Global MY 3.0 Platform offers a comprehensive suite of tools to support your trading journey:

- Personalised Interface: Tailor your trading environment to suit your preferences.

- Integrated Trading Tools: Access real-time analytics and live charts for informed decision-making.

- Multi-lingual Support: Benefit from assistance in various languages, catering to international investors.

Explore Phillip Capital’s platforms and tools and implement these insights effectively.